BMC Advisors

Due Diligence

For More Information:

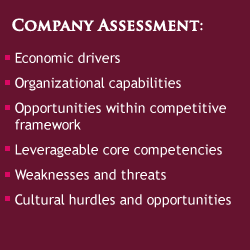

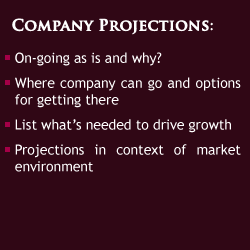

advisors@beveragemarketing.comBMC Advisors (BMCA) assesses markets, companies and opportunities for private equity firms as well as strategic buyers in order to provide them with an independent fact-based assessment of a potential targeted acquisition or investment. The knowledge of the beverage industry, network of contacts, proprietary information and in-depth understanding are what set BMCA apart from the rest and cannot be found anywhere else in the beverage marketplace.

This broad understanding and depth of knowledge provided at BMCA is leveraged in a number of ways for our clients when determining best and worst case scenarios, examining relationships with suppliers, identifying cost savings and synergistic opportunities and determining potential risks and opportunities against targeted acquisition.

Our perspective on the industry allows us to ask the right questions, ones that will lead to distinguishing between a strong or weak acquisition or investment.

- In what categories can the target best compete after acquisition?

- How can the proprietary technology of the target be leveraged further?

- Does the target have products or services that could be leveraged against other categories?

- What capabilities does the target have that could be leveraged in an acquisition or investment?

- What are the areas that should be addressed when evaluating the target company?

- Is the corporate culture of the target compatible with the culture of the acquiring or investing company?

- In their field of business, is the target a leader or follower and how does this play with the acquiring or investing company?

- What capabilities does the target have that can be replicated easily or that present a long term strategic asset/opportunity?

- What is the track record of execution by the target and how does it demonstrate the overall health of the company?

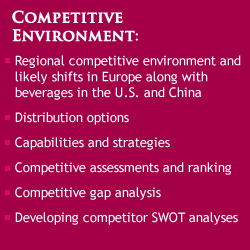

On a more practical level, BMCA has the ability to work effectively within the whole spectrum of the due diligence process and specializes in a wide array of acquisitions providing analytics through SWOT analysis, synergy analysis (cost and revenue), cost savings analysis, key agreement terms and drafting of letters of intent.

Samples of Recent Assignments